5 Strategies to Simplify SBA Loan Documentation and Boost Efficiency

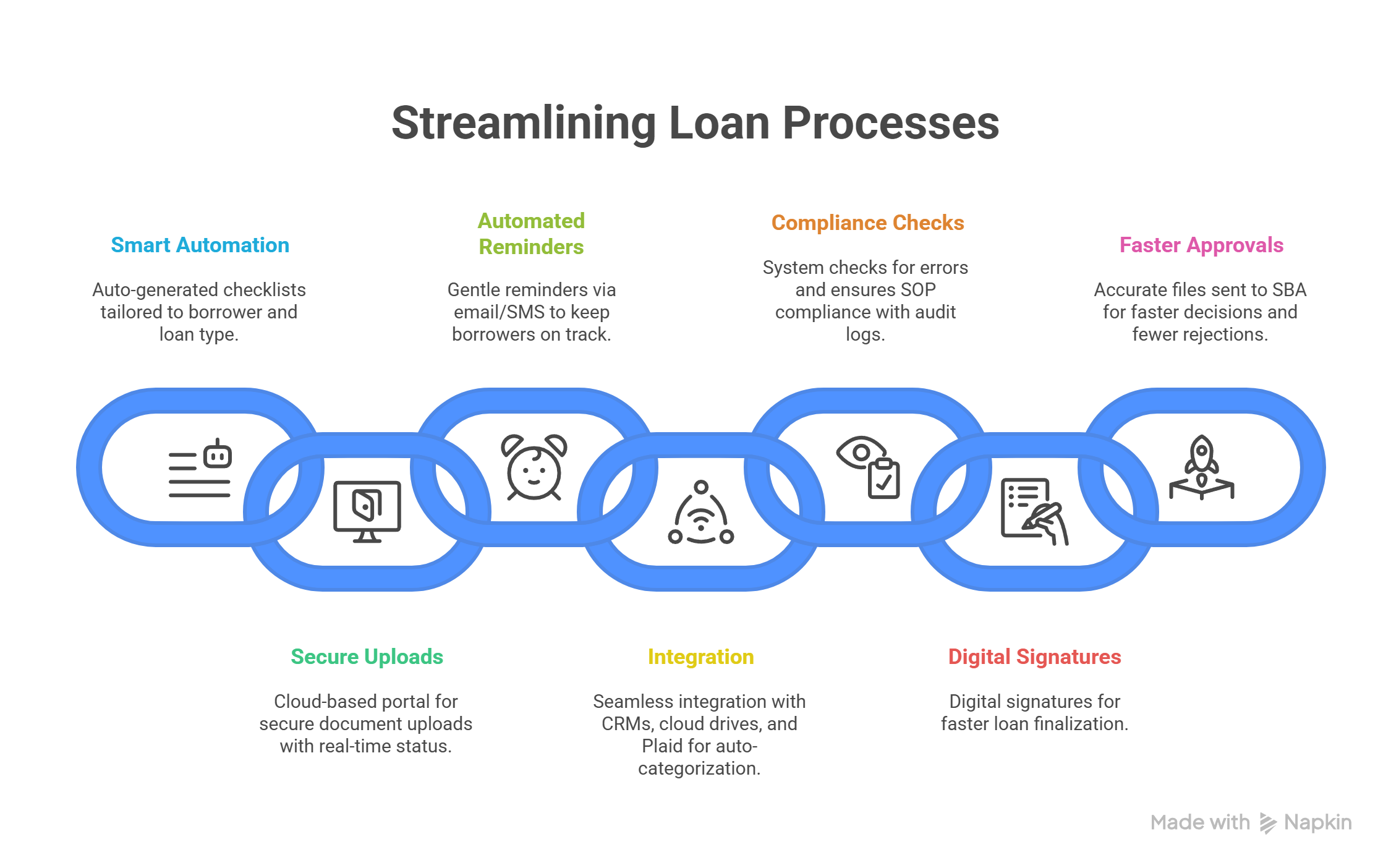

In today’s fast-paced lending landscape, lenders must deliver speed, accuracy, and a smooth borrower experience. These practical strategies help streamline SBA loan paperwork without compromising compliance.

SBA loans, such as the 7(a) and 504 programs, require extensive documentation, often pushing approval times of 60 to 90 days. These delays frustrate borrowers, raise lender costs, and risk losing deals. Research shows that technology is key to addressing credit access making streamlined documentation critical for modern lending.

5 Strategies to Simplify SBA Loan Documentation

1. Implement a Comprehensive Document Checklist

The SBA loan process can feel overwhelming to borrowers, requiring numerous documents. A checklist, like the LGPC Submission Checklist, ensures all paperwork is collected upfront while enhancing transparency by showing borrowers exactly what’s needed and their application status. This approach aligns with the SBA’s SOP 50 10 guidelines, which mandate specific documents for 7(a) and 504 loans, reducing delays and ensuring compliance.

2. Automate Document Collection and Organization

Manually sorting documents is slow and error-prone, with error rates of 0.55% to 3.6%. Automation tools extract and categorize data from documents like tax returns, ensuring accuracy and compliance with SBA guidance. These tools streamline processing, cut approval times, and reduce errors that could violate SBA standards.

3. Integrate with SBA Systems

Submitting loan applications to the SBA’s E-Tran platform manually is a recipe for errors and delays. Integrating your systems with E-Tran is like having a direct line, streamlining submissions, and ensuring compliance. The SBA offers a user guide for E-Tran submissions, which details how to connect systems for accurate, efficient data transfers, reducing approval times significantly.

4. Provide Borrower Portals for Easy Document Upload

Chasing documents via email is inefficient and frustrating for both lenders and borrowers. Borrower portals allow applicants to securely upload documents and track their status in real time. LendFoundry highlights that portals reduce paperwork, enhance borrower experience, and accelerate the process.

5. Train Staff on Efficient Documentation Practices

The best tools still need trained users. Regular training ensures staff are well-versed in SBA requirements and documentation best practices, minimizing errors and delays. The SBA provides training on demand for lenders, offering resources to keep teams updated and efficient, ensuring smoother loan processing.

Return on effort

These strategies align with 2025 digital lending trends, helping lenders grow and stay competitive. Here’s how they deliver tangible value to your lending process:

- Faster Approvals: Processing times from 60–90 days to weeks, keeping deals on track.

- Lower Costs: Automation minimizes manual labor and reduces error-related expenses.

- Improved Borrower Experience: Transparent, streamlined processes increase borrower satisfaction and trust.

- Enhanced Compliance: Automated tools ensure adherence to SBA regulations, lowering audit risks.

Ultimately, they do more than simplify paperwork; they equip lenders for long-term success.

Ready to simplify your SBA lending process?

Start by assessing your current documentation workflows to identify bottlenecks. Adopt tools that support automation, E-Tran integration, and borrower portals to streamline processes. Train your team and engage borrowers with clear, digital communication to maximize efficiency and satisfaction.

Adopting these five strategies, such as comprehensive checklists, automation, E-Tran integration, borrower portals, and staff training, SBA lenders can simplify documentation, reduce approval times, and enhance borrower experiences using document collection software like DocsNow.

These approaches align with the growing demand for digital lending solutions in 2025, ensuring lenders remain competitive. Hence, start implementing these strategies today to transform your SBA lending operations and deliver better outcomes for your borrowers.

"78% of bank customers choose digital channels, including mobile apps (55%) and online banking (23%), emphasizing the demand for tech-driven SBA lending." – Source: American Bankers Association