What is e-KYC: Just a Trend or a Necessity❓

Waiting in line at a bank or filling out endless paperwork has become a thing of the past. With digital transactions and online interactions becoming the norm, traditional procedures are struggling to keep up with the speed and convenience that consumers now expect. One such sector that is going through a radical change is the Know Your Customer (KYC) procedure, where Electronic KYC (eKYC) enters into a new era of security and efficiency.

What Is eKYC

To fully understand eKYC, we must first understand the KYC, or Know Your Customer procedure. KYC is used by companies and financial institutions to confirm the identification of its clients. Preventing identity theft, fraud, money laundering, and other illegal activities is the primary goal of KYC.

During the KYC procedure, individuals must give specific documents and information to confirm their identity. This might contain identification documents provided by the government, proof of address, and other relevant paperwork. Businesses can use the information gathered to make sure they are doing business with real clients and meeting legal requirements. Traditional KYC procedures, however, may involve tedious procedures, such as the physical submission of documents and human verification, which can cause delays and mistakes.

Many businesses are using eKYC, particularly financial institutions, to improve the efficiency of KYC. Electronic KYC, or eKYC, is centered on digital onboarding solutions and the online KYC procedure. Conventional know-your-customer procedures might involve offline phases, whereas eKYC transfers all procedures online, doing away with the need for paper records, in-person branch visits, and laborious manual tasks.

How It Works

- Verification with biometrics: Using biometric information, such as voice or facial recognition, provides clients with the most accurate results and ease. With their high-quality cameras, the majority of smartphones do not require any additional equipment.

- Verification of documents: A smartphone's camera can be used to digitally transmit official documents, such as birth certificates, passports, and proof of address. Using facial recognition software, the customer's selfie can then be compared to their photo ID.

- Two-factor and multi-factor authentication: These security measures lower the possibility of identity theft by requiring users to confirm transactions with a second hardware token or through several available channels.

- Digital breadcrumbs: IP address, browser settings, email address, typing speed, and other online meta-data are the sources of characteristic identifiers, also referred to as digital breadcrumbs. These can help prevent fraud while verifying an online identity.

- Reliable sources of information: Electronic identity verification can automatically compare people or organizations to official sanction lists, databases, registries, and whitelists maintained by the government.

Benefits of eKYC

eKYC offers numerous benefits, primarily due to its ability to automate processes that would otherwise require manual intervention.

For businesses, these advantages include:

- Increased processing speed: Customer information can be verified within seconds upon submission, significantly faster than manual review. This helps reduce drop-offs and boosts conversion rates.

- Decreased workload: With reduced reliance on manual review, financial institutions require fewer dedicated staff to KYC tasks, allowing for resource reallocation.

- Scalability: By minimizing the need for manual reviewers, eKYC processes facilitate business growth and scalability. Moreover, the 24/7 nature of eKYC enables continuous operation beyond regular business hours.

- Reduced human errors: Automated processes reduce the likelihood of human errors, leading to more efficient workflows.

For end-users, the benefits include:

- Convenience: Individuals and businesses can complete forms and applications without the need for physical document scanning, printing, or in-person visits to branches or offices.

- Fast approval process: Automated review of electronic data enables faster approvals and account creation for customers.

- Privacy: Using eKYC means that fewer people have to look at sensitive customer information because automated systems do the job. This leads to better privacy for customers.

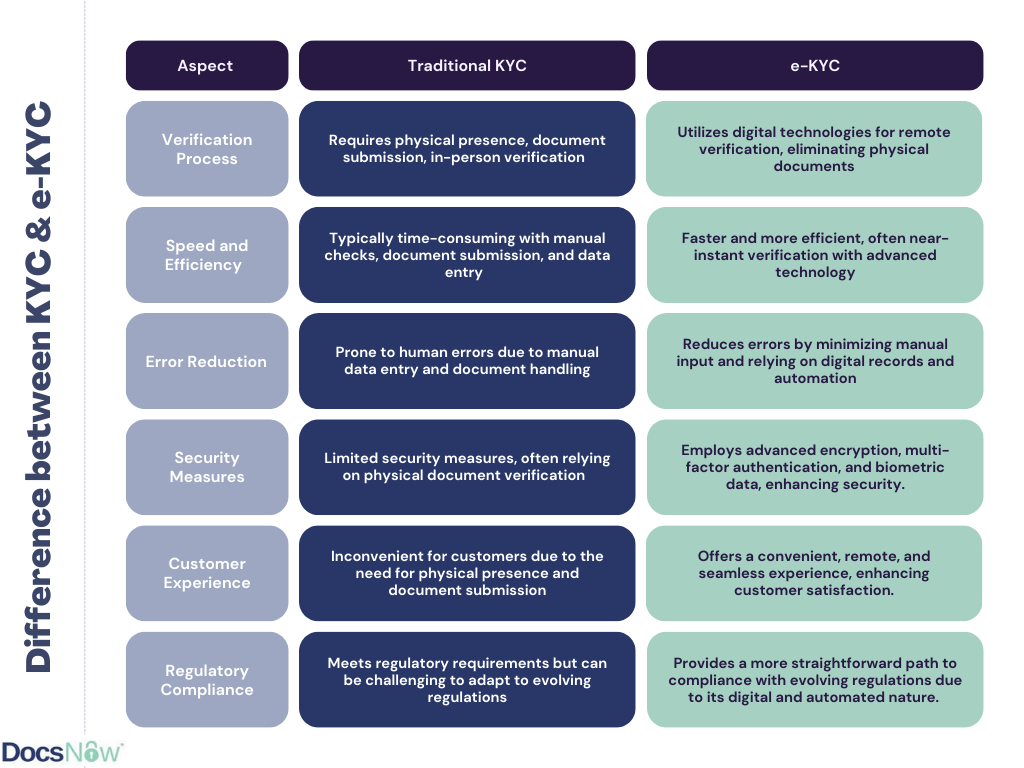

Difference between KYC and eKYC

Industries Adopting eKYC

Implementing eKYC is changing identity verification processes across sectors

Banking and financial sector:

Digital onboarding is now possible through electronic KYC, which has also made opening an account easier. It is now possible for customers to open bank accounts online without going to a branch in person. This has decreased expenses for financial institutions while also increasing user convenience.

Telecommunication industry:

To speed up the customer registration procedure, it has also adopted electronic KYC. Without the inconvenience of submitting physical documents, people may quickly activate their SIM cards, transfer their mobile numbers, and use other telecom services with eKYC.

Healthcare sector:

eKYC is being used by the healthcare industry in order to speed up patient registration and authentication procedures. Healthcare providers can ensure correct invoicing and insurance claims, access medical information, and instantly verify patient identities with electronic KYC.

Challenges of eKYC for Businesses

eKYC processes are crucial for businesses, but they come with challenges. Here are some common ones:

- Data Accuracy and Verification

Making sure customer information is accurate can be tough. Businesses need to verify identities, addresses, and other details to prevent fraud.

- Cost and Resources

Implementing strong KYC procedures requires investment in technology, staff, and training. Smaller businesses might find these costs hard to manage.

- Customer Experience

Finding a balance between thorough verification and a smooth customer experience is difficult. Long processes can annoy customers.

- Global Compliance

Businesses that operate internationally must deal with different regulations and compliance requirements in various countries.

- Technological Advancements

Keeping up with new technology like biometrics and AI for identity verification is essential but can be complicated.

Streamlining KYC Onboarding: Top Tools You Need

DocsNow is a cloud-based software solution that can transform the way you handle KYC process. Utilize this powerful platform to automate the collection of client documents from various sources and simplify the verification process, saving valuable time and resources. Improve the way you capture client information with our customizable forms. With DocsNow, you can complete the KYC onboarding process faster than ever.

- Expedite client onboarding 80% faster

- Admin dashboard to track progress on every request

- Enterprise-grade security

- Smart notifications to nudge customers

Onfido helps businesses create customized identity verification processes with their end-to-end, AI-powered solution. This automation enables you to attract new customers and cut costs while ensuring compliance with global KYC and AML regulations.

- Onboard more customers

- Navigate compliance

- Prevent advanced fraud

- Reduce cost and complexity

Sumsub's customizable solutions for KYC, KYB, transaction monitoring, and fraud prevention, you can make your verification process smoother, attract more customers worldwide, meet compliance requirements, save money, and protect your business.

- Biometrics

- Data Capture and Transfer

- Fraud Detection

- Identity Verification

Conclusion

In conclusion, eKYC is a major improvement in verifying customer identities in the digital age. It replaces the old, slow, and manual KYC process with a faster, more efficient, and secure digital method. eKYC uses advanced technology like biometrics and digital documents to speed up verification, reduce workload, and increase accuracy, making it more convenient for customers. It is becoming essential for banking, telecommunications, and healthcare industries, helping them meet modern demands for quick, safe, and easy customer verification.

Looking to expedite client onboarding? Reach out to us at DocsNow to book a demo call and elevate your customer onboarding process.